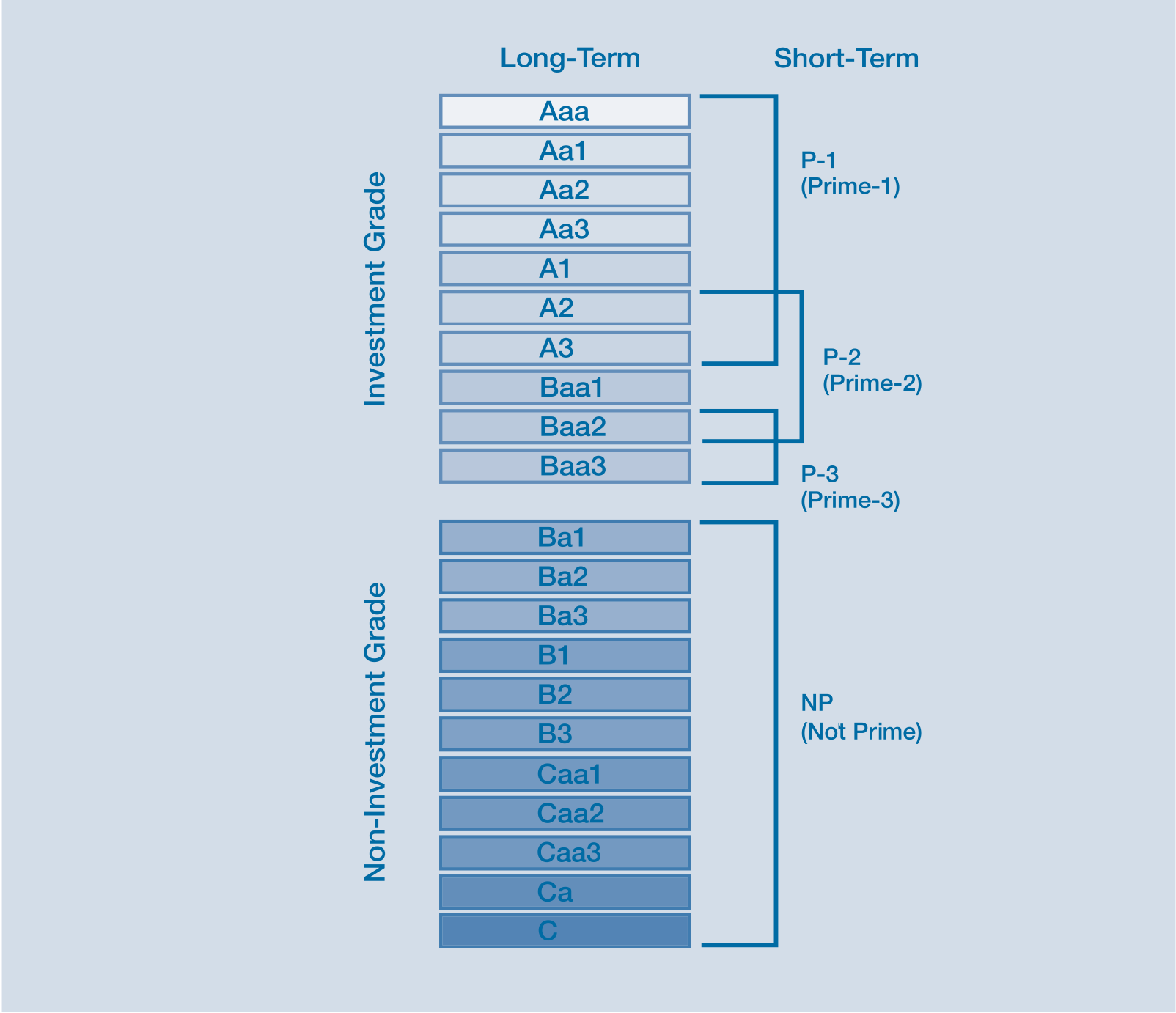

Moody’s has lowered Lebanon’s credit score to C, which is the same level as Venezuela. Obligations rated C are the lowest-ranked class of bonds and are typically in default, with little prospect for recovery of principal and interest. [Source]

The downgrade reflects Moody’s “assessment that the losses incurred by bondholders through Lebanon’s current default are likely to exceed 65%”.

In the mean time, the government has yet to present serious economic and fiscal policy reforms, and wants to pay foreign companies to audit his own central bank to score political points, instead of initiating a full-fledged audit on all governmental agencies and agreeing on a bail-out plan with the IMF once and for all.

[vivafbcomment]