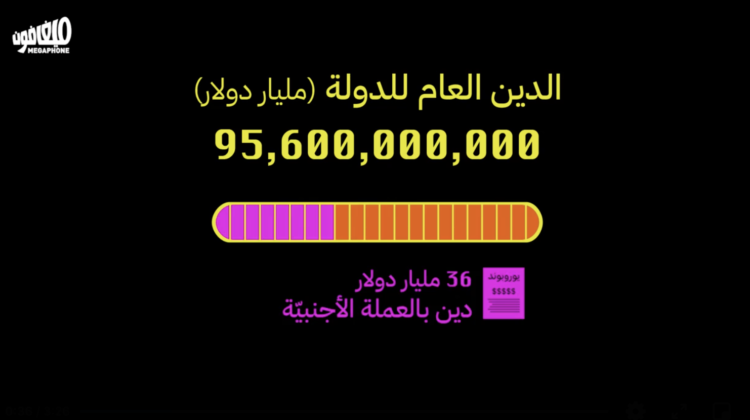

Megaphone shared a very interesting report on how Lebanon’s public debt has dropped by over 80 billion dollars since last year, mainly due to two factors:

– Eurobond prices have dropped sharply

– Lebanese bonds value has dropped significantly

In numbers, the Eurobonds have lost over 85% of their value and are now worth 5 billion instead of 36 billion dollars. Meanwhile, the Lebanese bonds are now valued at 7 billion at the market rate (12,000) instead of 59.5 billion dollars.

Of course this might sound like “good news”, as the government has a golden opportunity to cover some of its debt as part of its economic reform plan, but they don’t have a plan yet and couldn’t care less about implementing a reform plan. Instead,

Check out the report:

[vivafbcomment]